Investment Snippets #6

#STICKTOTHEPLAN: How to deal with Market Volatility

Volatile Markets rattle the nerves of investors, but we should remind ourselves why, as investors, we invest.

Consider that when we purchase shares in a company, we are buying ownership of that company, so we become a shareholder and that entitles us to a share in the profits. The profits may be distributed in the form of a dividend or invested back into the company. The upshot is when a company is profitable; it usually increases its net asset value.

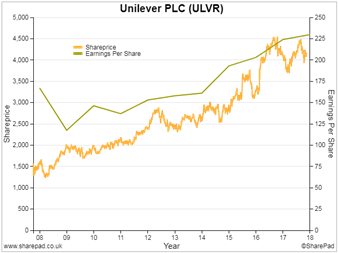

However, the profitability of a company is not always reflected in the share price and visa-versa, Price doesn’t always reflect profitability. This is highlighted in the chart which shows Unilever PLC’s share price and the company’s profitability which we measure using Earnings per Share. Here, we see even with consistent increasing earnings there is significant “volatility” in the share price.

The share price is what most people are familiar with and it can be difficult to tease out the cause of its volatility. Genuine reduction in profits due to changeable local economic factors, interest rate policy, bond yields and inflation, employment, political interference, and world trade agreements all influence investors emotions to varying degrees and therefore their appetite for investment which is reflected in the share price. A hard look at the facts is always warranted when we see volatility to understand that the investment case remains sound.

If you are a lump sum investor, then downward volatility has to be ridden out. Strong emotions will tempt you to SELL holdings and preserve the CASH. This is a mistake as it will likely crystallize a permanent loss, which if repeated frequently, is the quickest way to destruction of your wealth. Consider also, that you will likely be selling a good value asset at low price which is a bargain for a buyer on the other side.

On the other hand, we view Share price volatility as an opportunity to pick up quality assets at good value. If you are a regular investor, a monthly contribution invested will allow you to take advantage of a lower price paid for your holdings which can help to enhance long term capital appreciation.

And so back to Unilever, which if you had acquired in 31/10/2013 at a price of £25.01 per share, then today, 5 years later, that share is trading at £40.85, which represents a gain of £15.84 (63% or a compound growth rate of 10.31% pa).

How do we deal with market volatility?…….we ALWAYS look at a 5 year investment term.

If you have any queries, reservations, concerns or just want to talk it out, do give us a ring on 085 866 9813